IFRS Year End Closing

The IFRS Year End Closing process moves all unrealized market and forex balances, for each investment and instrument, to its corresponding balance sheet cost accounts, as pre-defined in the Posting Groups.

The IFRS unrealized allocation happens on the first day of the new fiscal year and once the revaluation is posted.

Notes:

-

Investment Ledger Entry’s ICY, PCY, and LCY Amounts specify the historical costs since inception.

-

Investment Ledger Entry’s IFRS ICY and IFRS LCY Amounts specify the IFRS costs.

-

Both historical and IFRS amounts are calculated in the ledgers regardless of the IFRS Average Cost activation in the Investment Ledger Setup. Nevertheless, the IFRS YE unrealized accounts write-off only occurs upon the IFRS YE closing validation.

-

The Boolean field “IFRS Close Line” in the Investment Ledger Entry can be used to easily isolate the transactions generated by the IFRS Year-End Closing Journal.

Year-End Accounting Entries

-

IFRS YE closing writes off the balance sheet unrealized market and forex accounts to the corresponding balance sheet cost accounts.

-

Standard BC YE closing writes off the income statement accounts to the balance sheet’s Retained Earnings account.

Elysys IFRS Year End Closing

Loan & Deposit IFRS Year End Closing

Note:

Upon running IFRS YE closing a new purchase line is created in the Investment Ledger and Loan and Deposit Ledger Entries. The line is the sum of all balance sheet cost accounts and unrealized accounts.

Setup

1. Investment General Setup

Path: Application Setup -> Investment General Setup

IFRS Average Cost needs to be enabled.

When the IFRS Average Cost option is Enabled, the IFRS Amount (LCY) value is posted to the General Ledger.

When the IFRS Average Cost option is Disabled, the value from Amount (LCY) is posted to the General Ledger.

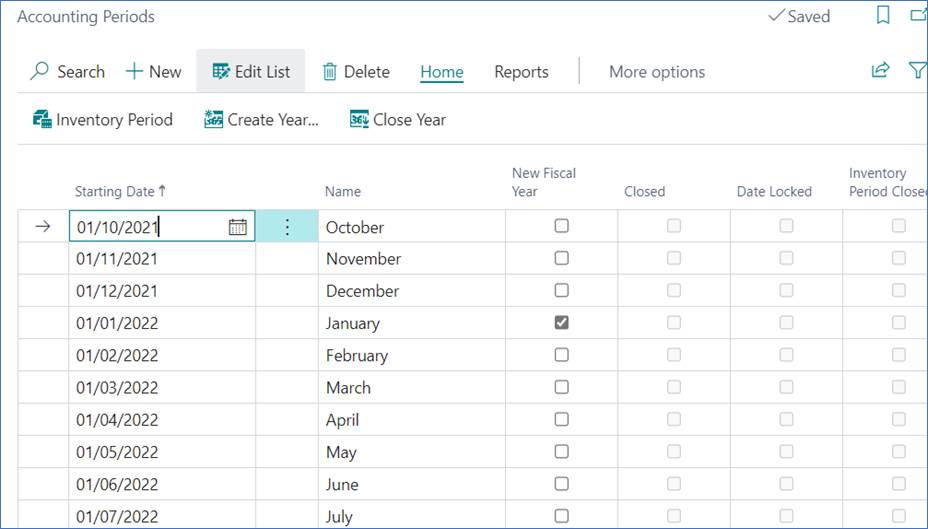

2. Accounting Periods

Accounting Periods and New Fiscal Year are defined in the Accounting Periods screen.

Investments

Pre Year-End Revaluation Transactions

Before Portfolio Revaluation is posted, only historical costs are reflected in the CoA for the transactions processed throughout the fiscal year.

Portfolio Revaluation

Before running the IFRS Year-End closing process, all investments must be revalued at their fair value.

Make sure that all trades are booked, and the latest market prices and exchange rates are imported.

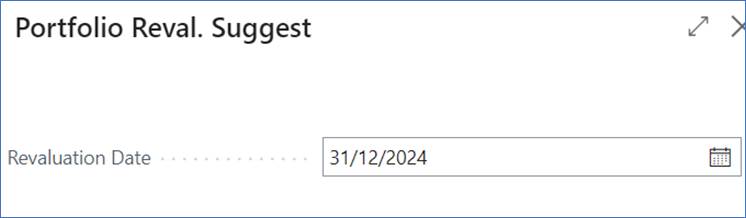

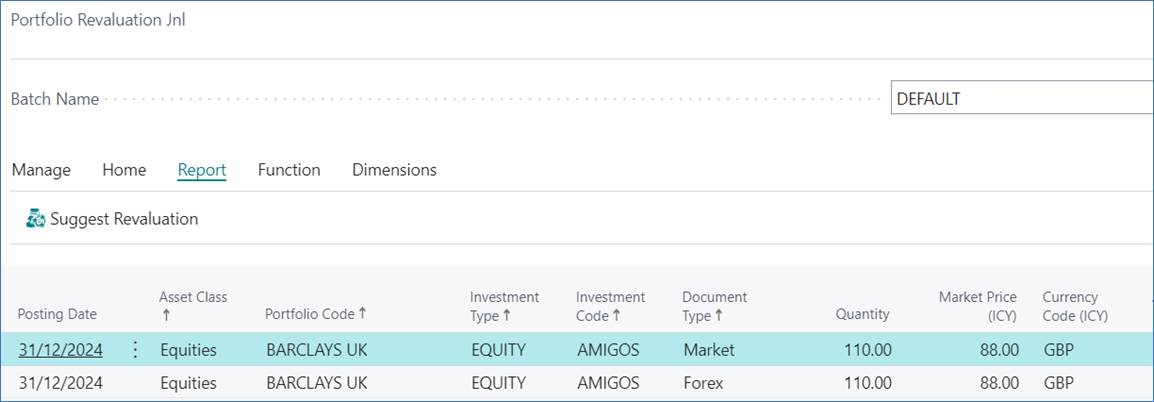

Once ready, proceed to the Portfolio Revaluation journal and suggest the revaluation entries for the last day of the fiscal year as defined in the Accounting Periods screen.

Path: Elysys Wealth -> Periodic Activities -> Portfolio Revaluation -> Process -> Suggest Revaluation

The portfolio revaluation journal generates unrealized market and forex lines for each investment’s open position which requires an adjustment.

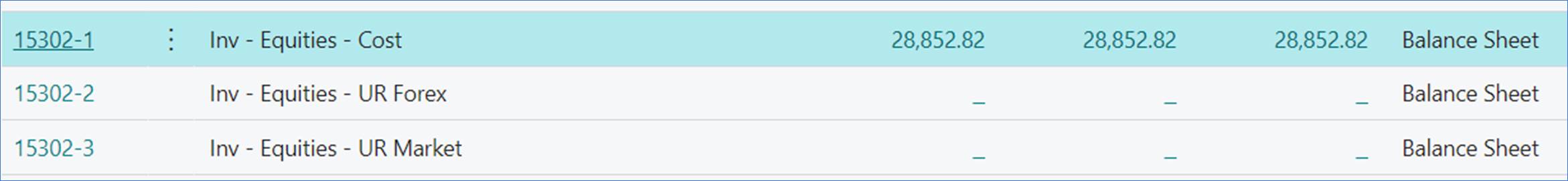

Post-Revaluation CoA

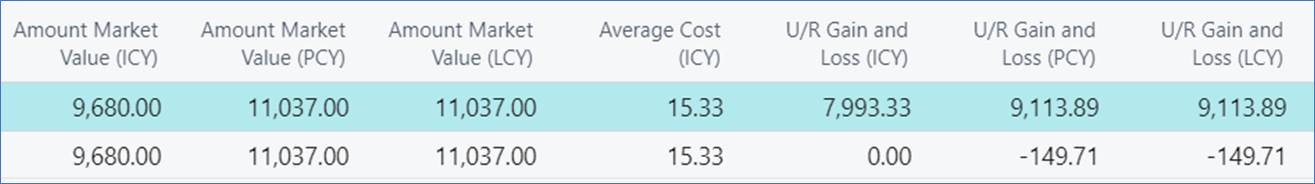

Posting revaluation entries calculates unrealized market and forex values for each investment and is posted to the corresponding G/L Accounts as per the account definitions in the Investment Posting Group.

IFRS Year-End Closing

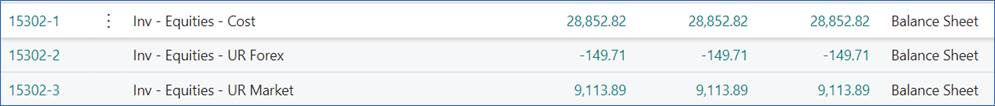

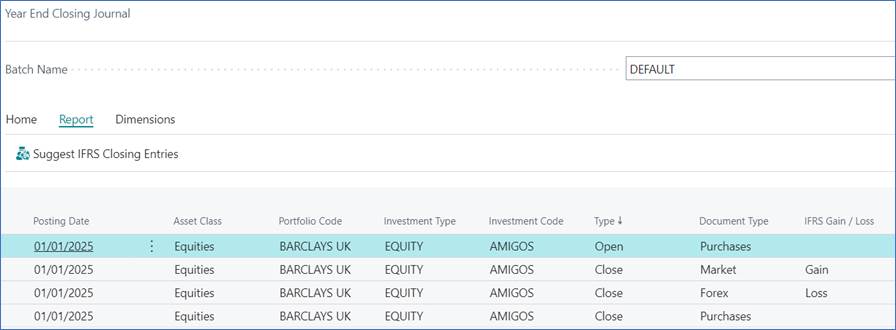

Path: Periodic Activities -> IFRS Year End Closing -> Report -> Suggest IFRS Closing Entries

The Opening Balance Sheet Date is selected from the dropdown list, and it is the first day of the new fiscal year.

For each investment, the following lines are suggested:

-

Closing entry (Type = Close) - writes off the cost and unrealized market and forex values.

-

Opening line (Type = Open) - which is the sum of all historical costs and unrealized market and forex values, corresponding to the fair value of the investment. The entry will be posted as a purchase on the first day of the new fiscal year.

Outcome

After the IFRS entries are posted, all unrealized market and forex balances are transferred to the cost accounts and are written off.

Loans & Deposits

Pre Year-End Revaluation Transactions

Loan & Deposit Revaluation Journal

Before running the IFRS Year-End closing process, all loans and deposits must be revalued. Make sure that all trades are booked, and the latest exchange rates are imported.

Revaluation lines for Loans & Deposits are suggested for the last day of the fiscal year via the Loan & Deposit Revaluation Journal.

Path: Elysys Wealth -> Periodic Activities -> Loan & Deposit Revaluation Journal -> Process -> Suggest Revaluation

Post-Revaluation Loan and Deposit Ledger Entries

Loan and Deposit Revaluation calculates unrealized forex amounts for each instrument and gets reversed and reposted to the next day to G/L Accounts as per definition in the Loan and Deposit Posting Group.

Loan and Deposit IFRS Year-End Closing

Path: Periodic Activities -> Loan and Deposit IFRS Year End Closing -> Report -> Suggest IFRS Closing Entries

The Opening Balance Sheet Date is the first day of the new fiscal year.

Posted IFRS lines are reflected in the Loan & Deposit Ledger Entries

All unrealized forex balances are transferred to the cost accounts and written off.